Maximize Your Refund with Expert Tax Preparation Services

Maximize Your Savings with Precision and Expertise at Focus Tax Group. Perfectly Preparing Personal and Business Taxes to Secure Your Financial Future!

Expert Tax Solutions Tailored for You

Experience unparalleled tax expertise with Focus Tax Group. We offer personalized solutions for individuals and businesses, ensuring accuracy, compliance, and optimized tax returns every time.

Streamlined Solutions for Your Tax Needs

Comprehensive tax solutions tailored for personal and business financial success.

**Personalized Individual Tax Preparation**

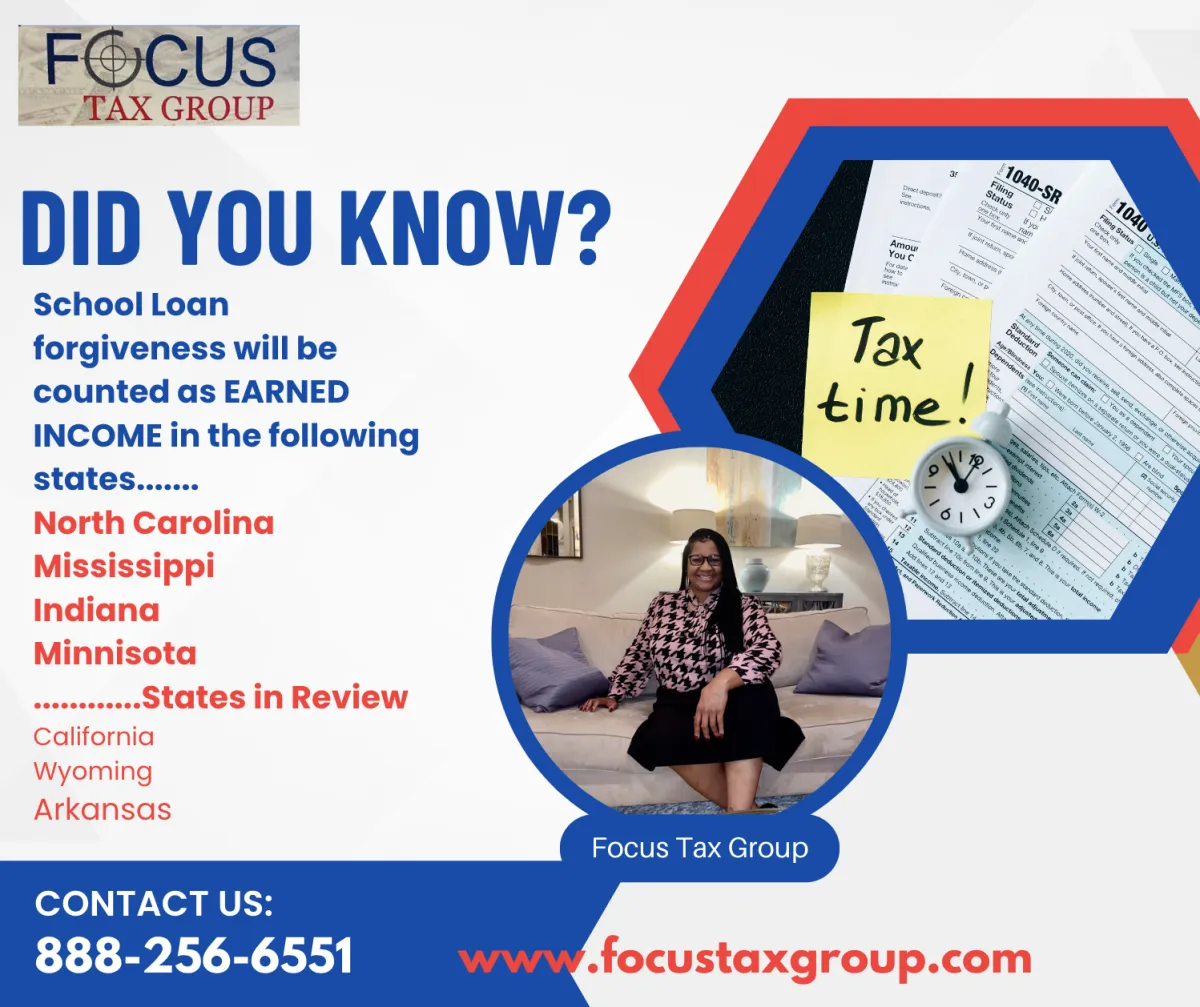

Personal Tax Preparation: Tailored services for individuals to maximize returns and minimize tax liabilities, ensuring compliance with updated tax regulations.

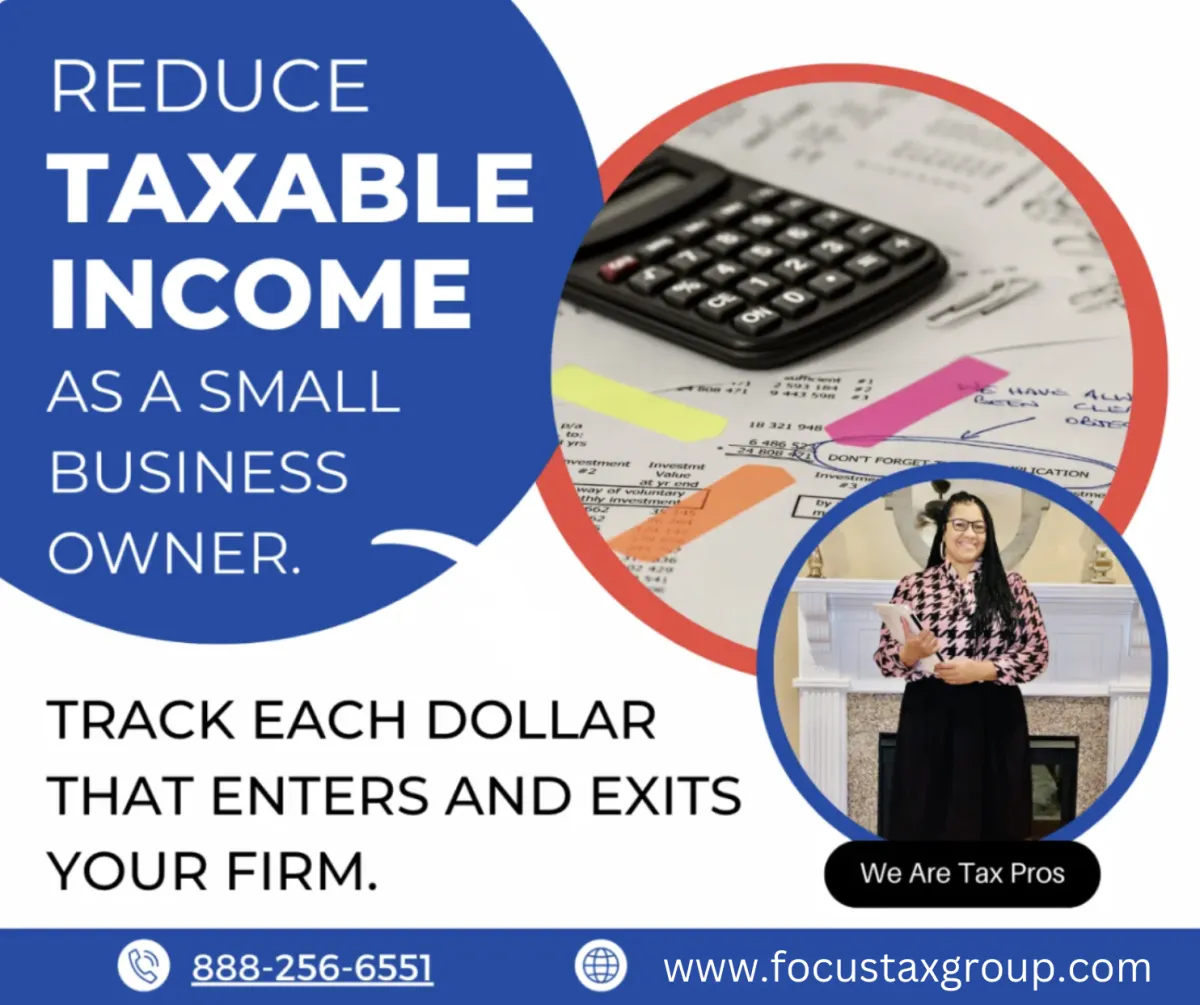

Business Tax Solutions

Comprehensive tax solutions for businesses, including strategic planning, filing support, and financial closure services, tailored to promote financial health and company growth.

Strategic Tax Planning Consulting

Tax Planning and Consulting: Strategic guidance to predict tax liabilities, uncover savings, and adapt to tax law changes, helping achieve financial goals.

FAQs

Got Tax Questions? Find Clear, Expert Answers Below!

What documents do I need for my tax preparation appointment?

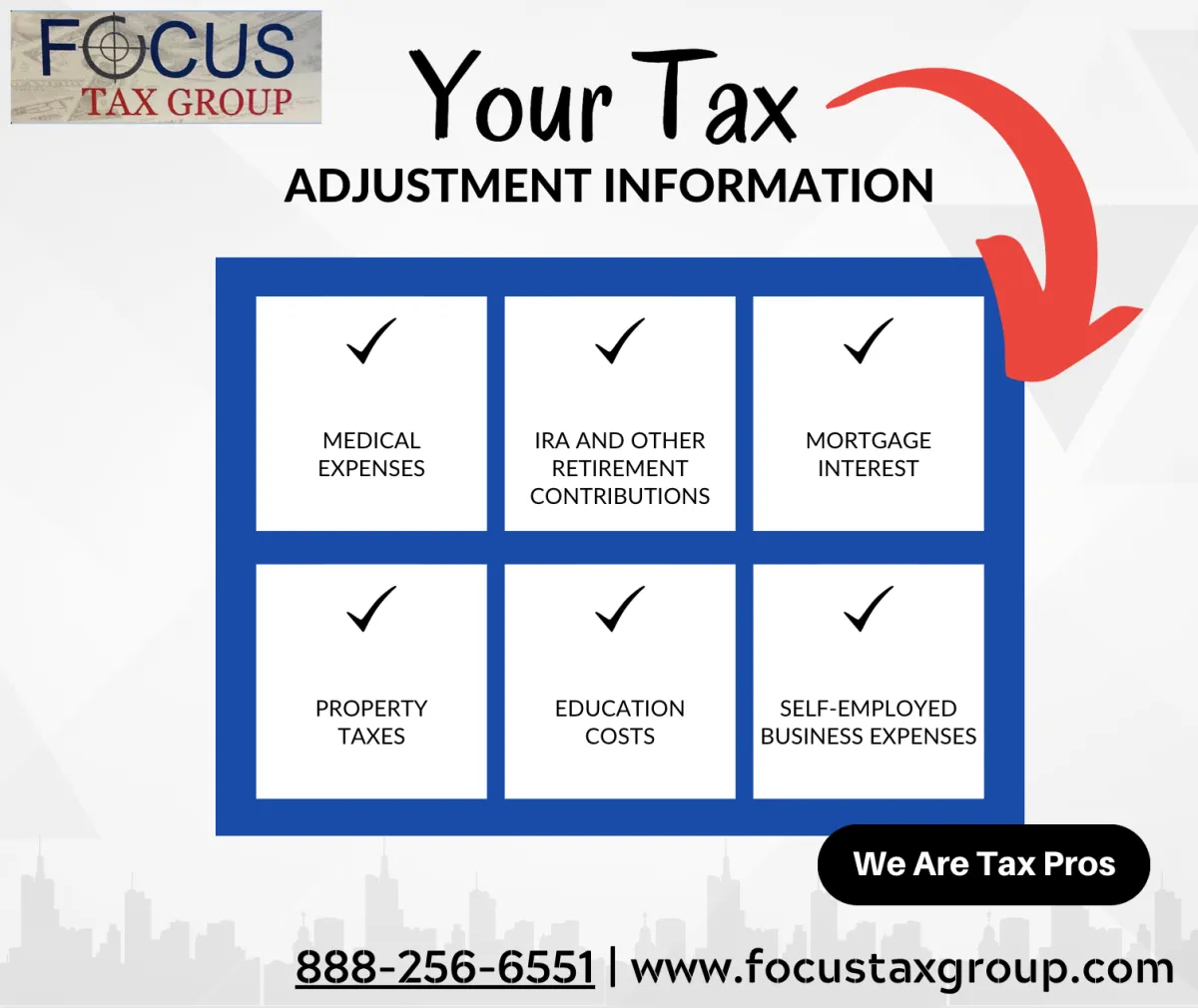

Please bring all W-2s, 1099s, investment income statements, and receipts for deductions such as medical or educational expenses.

How can I ensure that I am maximizing my tax returns?

Working with a Focus Tax Group professional can help you identify all eligible deductions and credits, keep you informed of new tax law changes, and provide personalized advice tailored to your personal or business finances.

What are the fees for your tax preparation services?

Our fees vary depending on the complexity of the tax situation. We offer a free initial consultation to assess your needs and provide a transparent quote based on the services required.

Is my personal and financial information safe with Focus Tax Group

Absolutely. We prioritize confidentiality and data security. All client information is protected with state-of-the-art security measures and is handled in strict confidence.

Can Focus Tax Group help if I havent filed taxes in previous years

Yes, we can assist you in filing back taxes. Our team will help gather necessary documentation, file the overdue returns, and negotiate with tax authorities, if necessary, to minimize any penalties or back taxes owed.

How often should I communicate with a tax advisor?

Consult at least once per year before tax season, or more frequently with significant financial changes.